Back in June, we organized a workshop for all of our employees on personal financial planning. This was a big request from our employees, as for the majority of them Impact Enterprises is their first formal job. They understood that saving for their future was important but wanted a clearer guide to achieve their goals.

We discussed the basic concepts necessary for investing – how a bank works, what is interest, why we have to consider inflation. We laid out specific steps to planning their savings, from goal setting to budgeting to matching goals to investment products. After the workshop, employees told us that they loved the practical information and felt more confident and prepared.

During the process, what was evident was the complete lack of knowledge when it comes to these topics, even from our employees, who are already quite brilliant. Sure, we all struggle with savings and budgeting, but not being educated on the basics of financial planning is particularly dangerous for people who are so economically vulnerable.

In a developing country like Zambia, the cost of goods can grow 6-8% annually and bank loans can reach over 20%. Without understanding how inflation and interest rates affect financial planning, an individual can be entirely excluded from banking options or, worse, be seriously harmed by a poor decision.

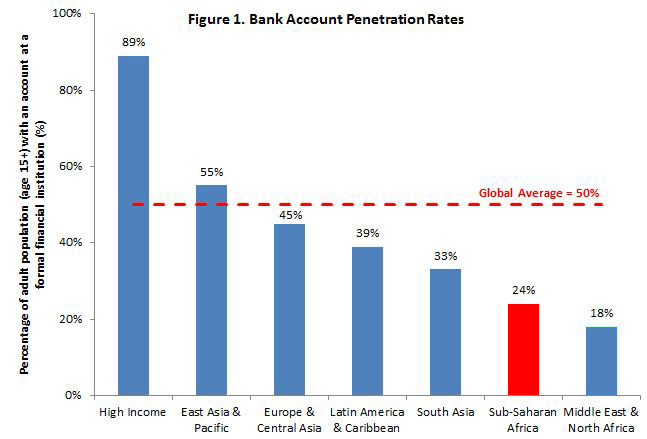

Source: The Global Financial Inclusion Database (the Global Findex)

Even knowledge of all the available investment options seems narrow. While planning our workshop, we asked our employees for the various accounts and securities they were aware of. Beyond the basic savings account, people had only faintly heard of other options. Only after doing our homework and meetings with financial planners did we find out that there were, in fact, quite a variety of options available.

As it turns out, banks offer lucrative fixed-deposit accounts (in the U.S. we’d call them certificates of deposits). These can offer returns of up to 13% annually for just a 2 year account – that’s 6% over inflation! Insurance companies offer college savings accounts for families planning for their children and even investment schemes tailored just for women that offer maternity benefits.

Obtaining this information certainly wasn’t easy. Looking up account terms on a Zambian bank’s website led to vague marketing blurbs and interest rate tables that defy all logic. At one bank, we were even denied a print out of the rates for various maturities of fixed-deposit accounts. How could someone plan their savings if they don’t even know what the returns will be?

This opaqueness in information is certainly evident in product adoption. Speaking with one financial advisor, he explained that 95% of his client base was expatriates. The problem, he said, was simply a high buy-in cost for some of these financial products. After doing the math, however, one could see that even a family with a moderate income could contribute to these plans. The real problem seems to be awareness, not affordability.

In any industry, prices and competition are driven by demand. As more customers demand a service or product, more new entrants try to offer newer and more innovate solutions. However, demand cannot exist without information. What we have in Zambia, and countless other countries, is a public that doesn’t know the basics of planning their savings and therefore can’t demand the products that they deserve. While the World Bank reports improvement in Sub-Saharan Africa, with 34% of adults having a financial account in 2014 compared to 24% in 2011, there is still a lack of access to formal savings accounts and borrowing. Only 16% of adults in the region are reported to have a formal savings account and only 6% have access to formal borrowing.

While poor savings and financial planning habits are often blamed on the lack of access to financial products, that is in fact incidental to the lack of education. Increasing basic financial education goes hand in hand with increasing financial inclusion, which is the access to affordable financial services by disadvantaged segments of society. Furthermore, when we don’t educate the public on how broader concepts – such as inflation – impact their savings, it limits the positive effect financial inclusion can have on communities.

As is common in developing countries, the public education system is already overburdened to meet the challenge. This gives the private sector the opportunity to fill the knowledge gap. As a social enterprise, we at Impact Enterprises put considerable effort into educating and developing our employees. We see this as the best model for business to be sustainable. Providing financial education means our employees are more responsible to themselves and can better participate in the financial system in the future.