Part 2 of 2

Recently, we looked at how social enterprises are establishing a model for future industries. By blending social awareness into traditional business practices, companies gain various benefits that lead to long-term results. At first glance, this may seem obvious and optimistic, but how do we actually measure the social impact?

Measuring the social impact of these organizations can be difficult, but the Global Impact Investing Network (GIIN) is attempting to standardize impact research and measurement through their Impact Reporting and Investment Standard (IRIS). The IRIS catalog is designed to work across sectors and applies to various measures of performance including financial, operational, product, sector, social and environmental objectives.

By utilizing standardized impact measurement tools, new investors are able to fairly compare potential investments based on quantifiable data. Social investment fund managers are able to track the performance of their funds with ease. The social entrepreneur is more easily able to track the impact of their company and demonstrate its scalability. Finally, the general public will have a more transparent view of the social enterprise.

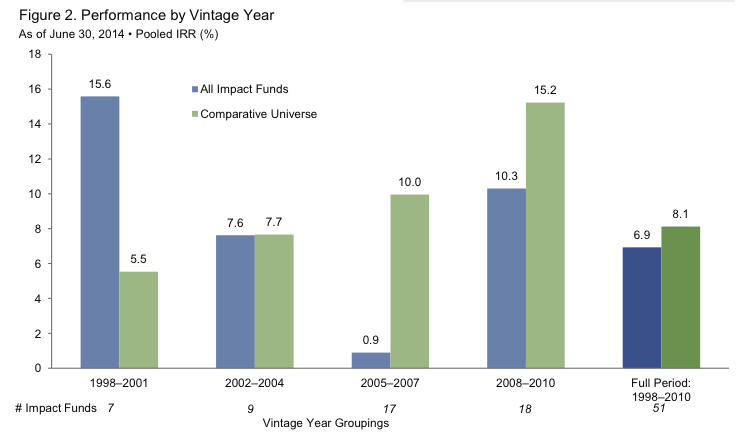

From the data gathered so far, this model of sustainability seems to be working. According to the recent GIIN Impact Investing Benchmark Report, social investment funds formed between 1998 and 2004 have outperformed comparative conventional private investment funds. Social investment funds were also more likely to weather the 2008 financial crisis. More recently launched impact funds trail their peers, but this is in large part due to the longer investment horizon for impact investors.

Overall, the study finds social impact funds are performing mostly in line with conventional peers. These figures demonstrate that being socially minded can have high returns on investment for all involved.

Source: Cambridge and Associates, GIIN Impact Investing Benchmark, 2015

From personal experience, being socially minded has benefited us at Impact Enterprises as well. We realize our mission of creating valuable employment in Zambia by providing not just jobs but professional development for our employees. Internally, this results in more dedicated employees and higher overall satisfaction. For our clients, they know that they are offshoring their work in a socially conscious manner. This means we are able to stay competitive even against more established peers.

The question ahead is, what will happen to social enterprises as they grow? As more players become involved in the sector, how will that tip the balance of supporting stakeholders versus satisfying shareholders? For example, in April 2015, Etsy, a certified B-Corp, went public, being only the second company to do so. As a publicly traded company, they will be particularly responsible to their shareholders who have the right to dictate the course of the business.

Public companies are often criticized for focusing on short-term profits over long term economic sustainability. Can these companies that are accountable to profit minded parties – be it the investment funds or shareholders – find the right model of maintaining their social impact?